In my thesis, I delved into the burgeoning field of UAV security, given the rapid increase in drone accessibility and corresponding concerns about potential misuse. My primary focus was on countering threats posed by hostile drones in military contexts. I proposed an innovative drone defense system that uses a countermeasure drone, equipped with AI algorithms to analyze RF signals, for threat identification and neutralization.

The backbone of my research was the development of two machine learning models – XGBoost and LSTM. These models were trained on a diverse dataset, including LOS and NLOS RF signals from UAVs, random noise, and UAV controllers. I simulated a real-world environment in Unreal Engine 5 for model validation, mirroring complex scenarios such as the Russia-Ukraine conflict, where drones emerged as a significant strategic factor.

The system’s initial evaluations suggest promising efficacy in countering drone threats, though further investigation is needed to test its adaptability across varying environments and rapidly evolving drone technologies. With this research, I’ve significantly contributed to drone security, introducing an inventive strategy for mitigating aerial threats across various contexts.

ABSTRACT

As a consequence of recent technological advancements in the domain of commercial Unmanned Aerial Vehicles (UAVs), accessibility to these sophisticated tools has become significantly more prevalent among the general populace. However, this escalation in availability also provokes substantial concerns pertaining to the potential exploitation of these UAVs for the execution of malicious activities. Whilst the issues of privacy and military utilization remain paramount, this thesis will concentrate primarily on the military deployment of these drones. Our specific interest lies in the countermeasures developed to thwart hostile attacks. In the presented study, we introduce a novel drone defense system concept that encompasses a countermeasure Unmanned Aerial Vehicle (UAV). This system identifies potential adversarial UAVs by leveraging the analytical capabilities of Artificial Intelligence (AI) algorithms to scrutinize Radio Frequency (RF) signals. Once hostile UAVs are detected, our proposed system neutralizes the threat through a mid-air collision approach. This investigation finds grounding in real-world geopolitical contexts, specifically drawing upon instances like the Russia-Ukraine conflict, wherein the utilization of drones emerged as a significant factor in the strategic landscape. In this research, two distinct machine learning models, namely XGBoost and Long Short-Term Memory (LSTM), were trained on a dataset incorporating both Line of Sight (LOS) and Non-Line of Sight (NLOS) Radio Frequency (RF) signals originating from UAVs, random noises, and UAV controllers. These constructed models were subsequently validated within a simulated environment created in Unreal Engine 5, which approximates real-world scenarios. Preliminary evaluations of this defensive strategy have indicated promising efficacy in mitigating the increasing prevalence of drone threats in military contexts. Nevertheless, additional research is mandated to ascertain the system’s resilience and adaptability across a diverse range of environments and in response to the rapid evolution of drone technologies. The outcomes of this study make a significant contribution to the burgeoning field of drone security, introducing an innovative strategy for neutralizing aerial threats in a variety of situational contexts.

https://github.com/vanreusVU/Delaunay-Triangulation

Delaunay Triangulation in Python using Bowyer–Watson algorithm. In computational geometry, the Bowyer–Watson algorithm is a method for computing the Delaunay triangulation of a finite set of points in any number of dimensions. The algorithm can be also used to obtain a Voronoi diagram of the points, which is the dual graph of the Delaunay triangulation.

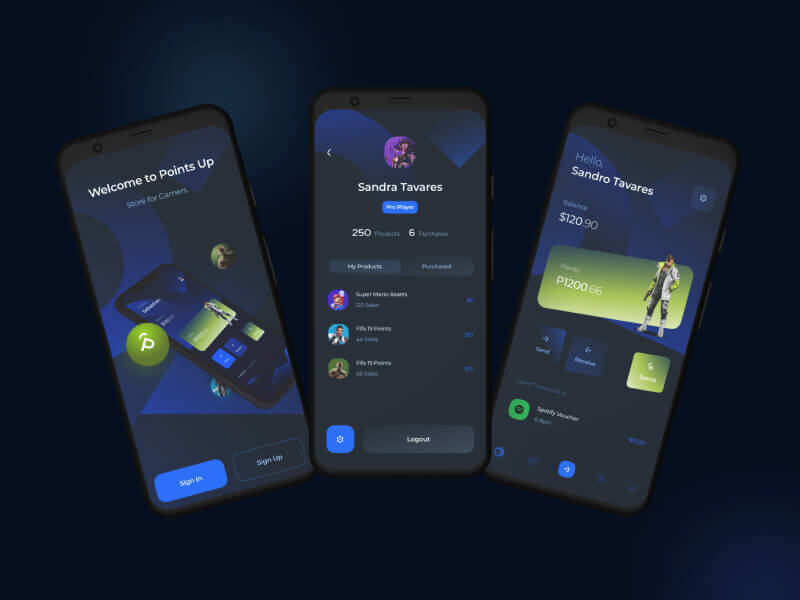

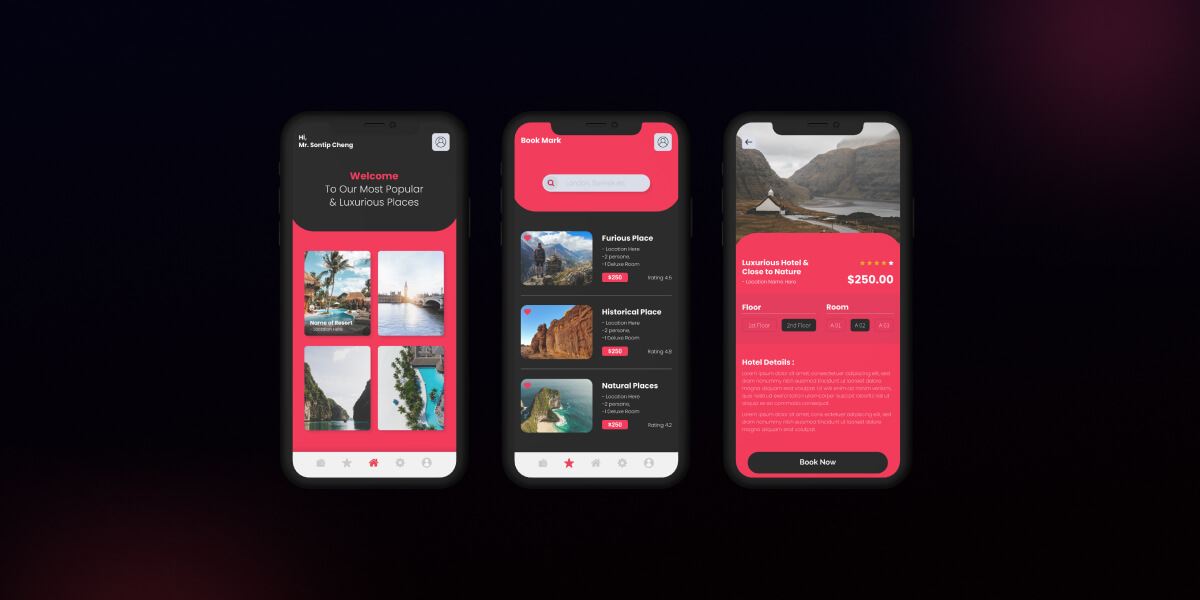

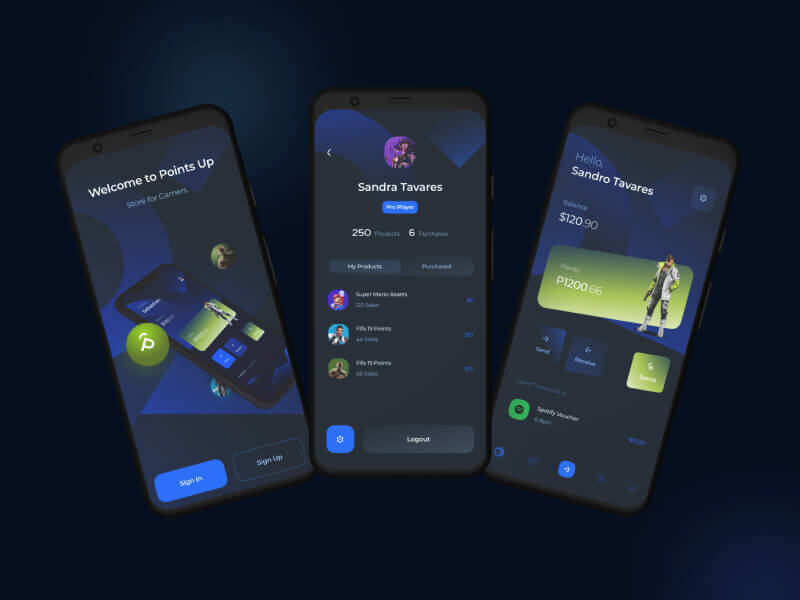

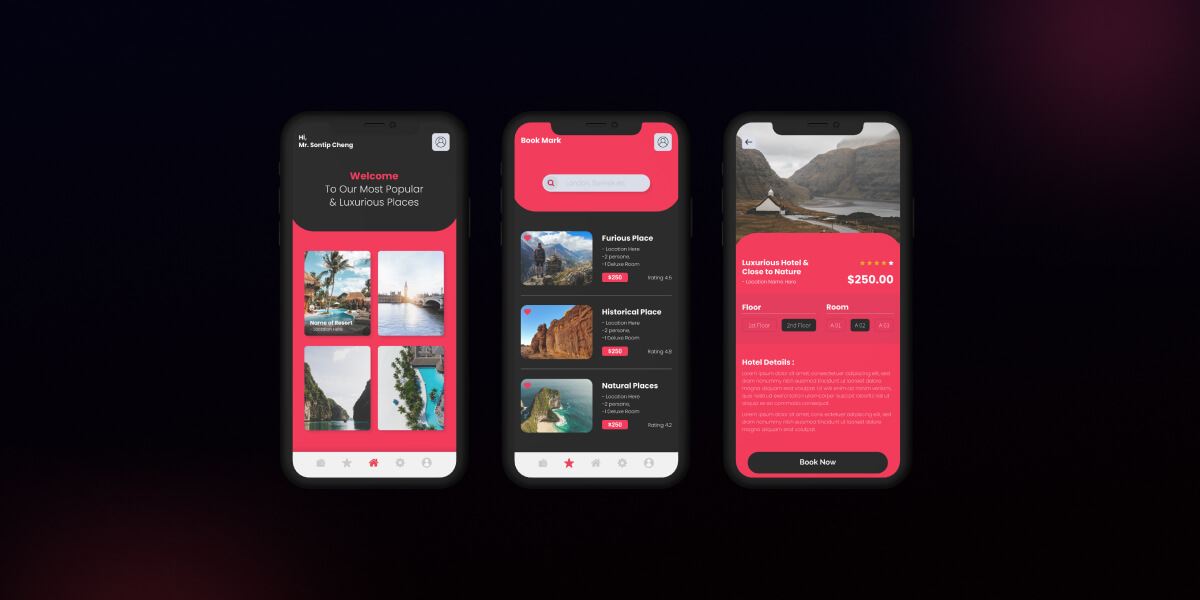

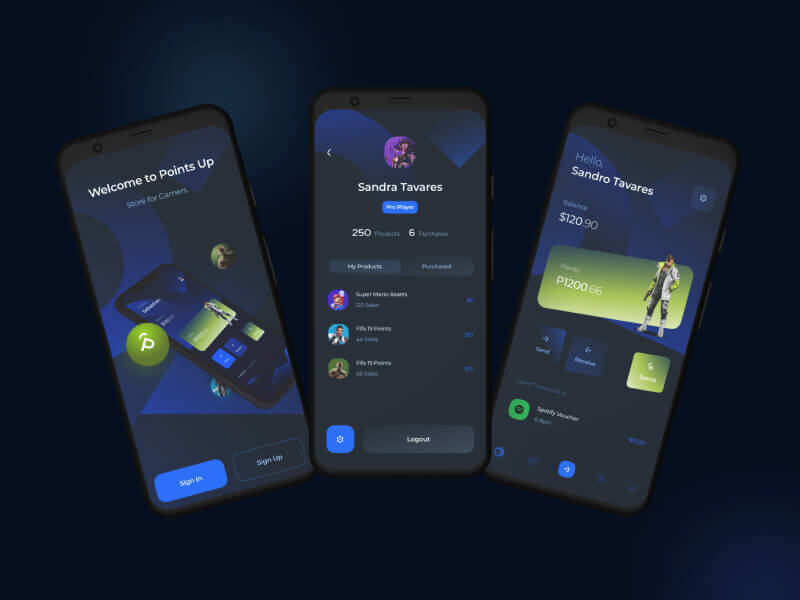

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

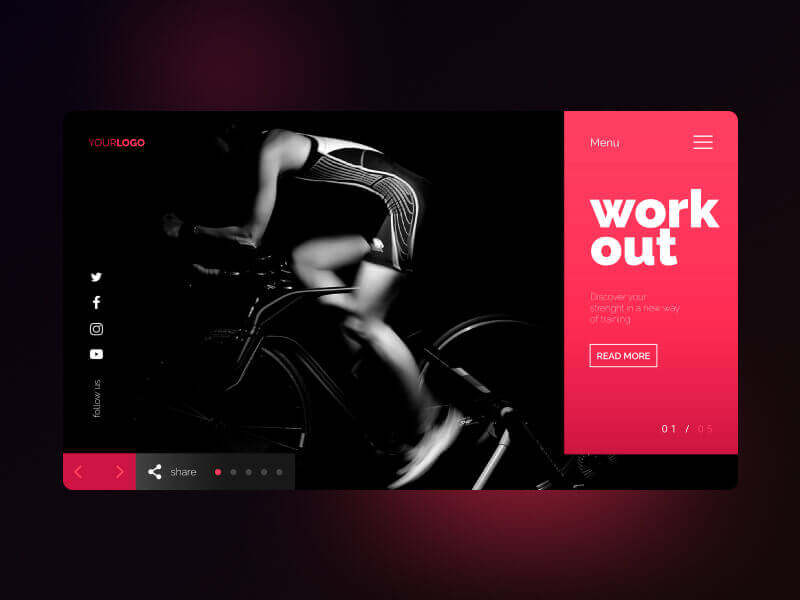

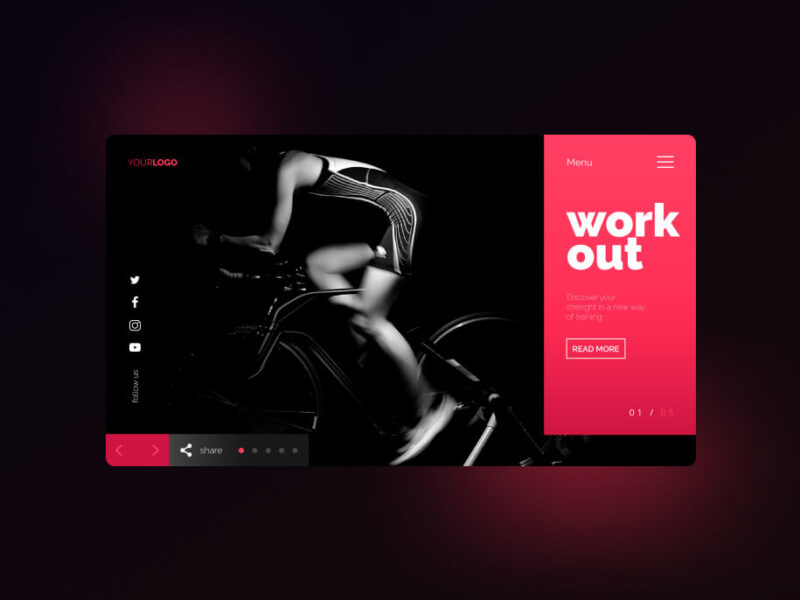

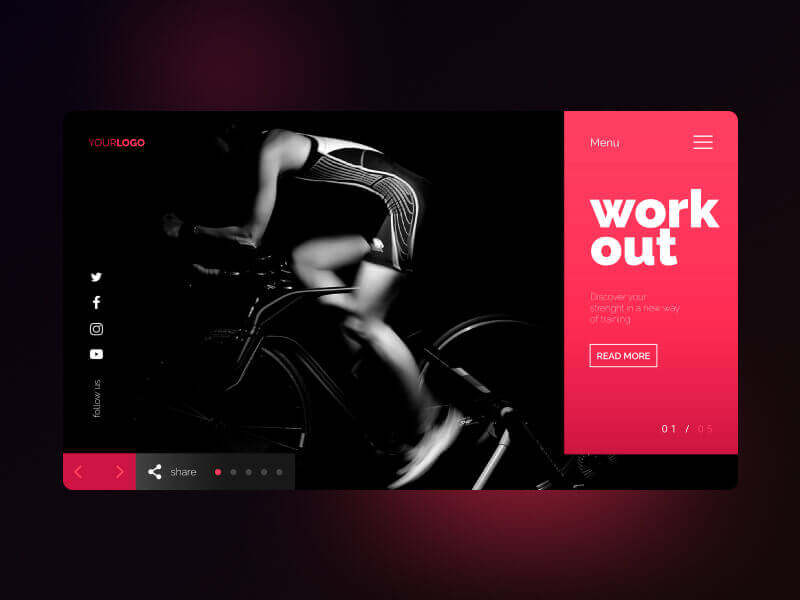

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications.

UI/UX Design, Art Direction, A design is a plan or specification for art viverra maecenas accumsan.

Through a wide variety of mobile applications, we’ve developed a unique visual system.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

A strategy is a general plan to achieve one or more long-term. labore et dolore magna aliqua.

UI/UX Design, Art Direction, A design is a plan or specification for art. which illusively scale lofty heights.

User experience (UX) design is the process design teams use to create products that provide.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.